Table of Contents

- Demystifying the Potential of Digital Currencies

- Approaches for Profitable Trading in copyright

- Strategic Investing in Blockchain Innovations

- Embracing DeFi: The Future of Finance

- Contrasting Forex and copyright Markets: Opportunities and Challenges

Demystifying the Potential of copyright

The copyright stands out as a revolutionary power in the monetary landscape.

It offers a decentralized alternative to conventional money, promising greater security and transparency.

Grasping the basics of this novel technology is crucial for anyone looking to participate in the copyright space.

Starting with its inception with bitcoin to the emergence of ethereum, the market continues to evolve at a rapid pace.

Navigating this complex world demands careful research and a thorough understanding of its foundational principles.

With its constantly growing uses, copyright is redefining the way we perceive finance and exchanges.

Adopting this innovative domain can possibly result in considerable advantages.

Approaches for Profitable Trading in Digital Markets

Participating in trading across the digital asset market demands a methodical and knowledgeable approach.

It is crucial to create a robust grasp of market movements and technical indicators.

Successful traders often employ various techniques to mitigate exposure and optimize returns.

- Perform in-depth market analysis to identify trends and opportunities.

- Implement efficient exposure control plans, including setting stop-loss orders.

- Diversify your portfolio amongst different copyright assets to reduce fluctuations.

- Stay updated on the latest news and governance changes impacting the copyright market.

- Practice emotional discipline and avoid rash choices based on panic or greed.

Whether you're concentrating on bitcoin or investigating altcoins like ethereum, mastering trading is a continuous learning journey.

Endurance and adaptability are key to succeeding in this ever-changing environment.

"The copyright, strategic trading is not merely about making money, but about understanding the rhythm of the digital economy and mastering controlled implementation."

Long-Term Investing in Decentralized Innovations

Beyond the short-term fluctuations of trading, investing in copyright presents a path for long-term financial accumulation.

It entails identifying projects with robust fundamentals, cutting-edge technology, and viable use cases.

Focusing on the underlying blockchain infrastructure and its potential to revolutionize various industries is paramount.

Take for instance, ethereum's self-executing agreement capabilities have opened up unprecedented possibilities in decentralized applications.

Thorough due diligence, such as evaluating the group behind a project and its user base, is critical.

Endurance is a virtue in investing, as the market can be unpredictable, but long-term holdings frequently produce significant returns.

Through adopting a long-term perspective, investors can benefit from the transformative power of copyright.

Understanding DeFi: The Future of Decentralized Finance

DeFi, or Decentralized Finance, symbolizes a paradigm shift in the monetary sector, leveraging blockchain technology.

It aims to reimagine traditional financial services, including lending, borrowing, and trading, without the need for intermediaries.

The emergence of DeFi has been fueled by the advancement of platforms like ethereum, which enable self-executing agreements.

Users can utilize a range of financial products straightforwardly, promoting greater accessibility and efficiency.

However, comprehending the hazards associated with DeFi, such as smart contract vulnerabilities and temporary depreciation, is crucial.

Despite these challenges, DeFi's capability to democratize finance and build a more fair system is immense.

As the ecosystem develops, DeFi is set to redefine the future of global finance.

Contrasting Forex and copyright Markets: Opportunities and Challenges

While both forex and copyright markets center around the trading of assets, they present distinct characteristics and possibilities.

The forex market, known for its enormous liquidity and long-standing regulatory frameworks, has been a staple of global finance for decades.

Conversely, the copyright market, newer, provides greater volatility and the potential for rapid gains, albeit with increased exposure.

Bitcoin and ethereum are leading examples of assets that can undergo considerable price fluctuations in a short period.

Grasping the differences in market hours, leverage, and underlying technologies is key for traders.

Forex markets are generally less volatile, while copyright platforms are frequently impacted by digital advancements and public sentiment.

Deciding between which market to participate in is contingent on an trader's comfort with risk, investment goals, and preferred trading style.

"I was initially apprehensive about entering the world of copyright trading, due to its perception for unpredictability. Nonetheless, after carefully researching different platforms and understanding the concepts of bitcoin and ethereum, I felt more. The insights I acquired into DeFi were especially revelatory, demonstrating the true potential of decentralized finance. My journey into investing has been remarkably life-changing. I've discovered to navigate the market with greater confidence, comprehending that endurance and ongoing learning are paramount. It's been an incredible journey witnessing how copyright is reshaping the financial landscape, and I'm eager for what the next phase holds in this dynamic space. I highly recommend those curious in digital finance to explore these opportunities."

Frequently Asked Questions about copyright

- Q: What is the primary difference between bitcoin and ethereum?

A: Both are prominent cryptocurrencies, bitcoin is primarily a digital store of value and a transaction method, often dubbed as "digital gold." Ethereum, on the other hand, is a decentralized platform that enables the development of smart contracts and decentralized applications (copyright), making it a core element of the DeFi ecosystem. - Q: How can I start trading copyright?

A: To begin trading copyright, you should first choose a trustworthy copyright exchange. Next, you'll need to register, finish identity verification (KYC), and deposit funds. It is recommended to start with a small sum and learn about market trends, chart patterns, and risk management tactics before committing larger amounts. - Q: Why is investing in DeFi?

A: Investing in DeFi offers several main benefits, including increased accessibility to financial services without intermediaries, potentially higher yields compared to traditional finance, and improved transparency through blockchain technology. Additionally, promotes broader access to finance and innovation in the financial sector. Nevertheless, it's crucial to be aware of the intrinsic dangers, such as smart contract bugs and price fluctuations.

trading

| Feature | copyright (e.g., Bitcoin, Ethereum) | Forex (Traditional Currencies) |

|---|---|---|

| Volatility | Significant, with capability for rapid price fluctuations | Relatively stable, influenced by financial data and geopolitics |

| Market Hours | 24/7 availability, no breaks | Five days a week, with weekends closed |

| Decentralization | Highly decentralized, peer-to-peer transactions | Regulated by banks and financial institutions |

| Regulation | Evolving and varied across different jurisdictions | Mature and rigorously regulated |

| Accessibility | Globally accessible, needs internet connection | Widely accessible, but can have entry barriers for some |

"Having been deeply engaged in copyright trading for over three years, and I can confidently say that grasping the subtleties of bitcoin and ethereum has been revolutionary. The insights provided by various online resources and groups have truly helped me manage the unpredictable market. Educating myself on DeFi has also opened up a whole new dimension of investing possibilities. I strongly recommend everyone interested in the future of finance to delve into these areas. The potential for growth and advancement in copyright is unmatched, and I'm eager to keep discovering and growing within this dynamic space. It's truly a fascinating and rewarding journey."

– Alex K.

"As a beginner in the forex market, I was initially intimidated by the complexity. However, after exploring copyright and its potential, especially ethereum's role in DeFi, I found a more intuitive approach to investing. The resources available for understanding trading strategies in the copyright space are abundant, and the network support is great. I've acquired so much about market movements and exposure control methods that have been priceless. While forex has its merits, the innovation and growth in the copyright world are truly engaging. I believe surer about my monetary decisions now, thanks to the knowledge I've gained in this exciting new realm of finance. I'm hopeful about my prospects in copyright investing."

– Sarah L.

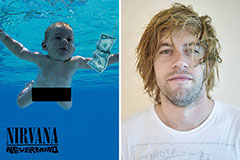

Spencer Elden Then & Now!

Spencer Elden Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!